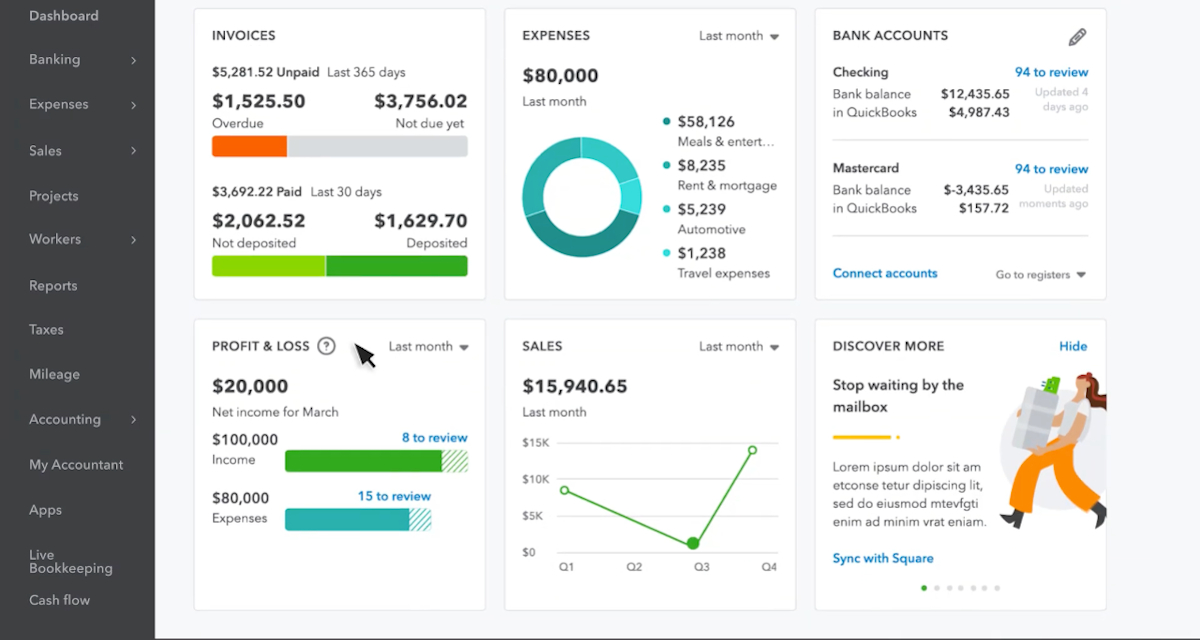

Personally I like quickbooks for the most part. I wish the mobile application more closely resembled the online web platform. I'm able to pull up the online platform from my iPad, which is the direction I tend to go when using Quickbooks from a mobile device. I've found that it lacks features or is harder to navigate than the online platform. I do not particularly like the Quickbooks mobile application. I can track payments, invoices, project management, etc. It is easy to use with an incredibly intuitive user interface. I am able to manage my business from an iPad, which gives me the freedom that I need to move around.

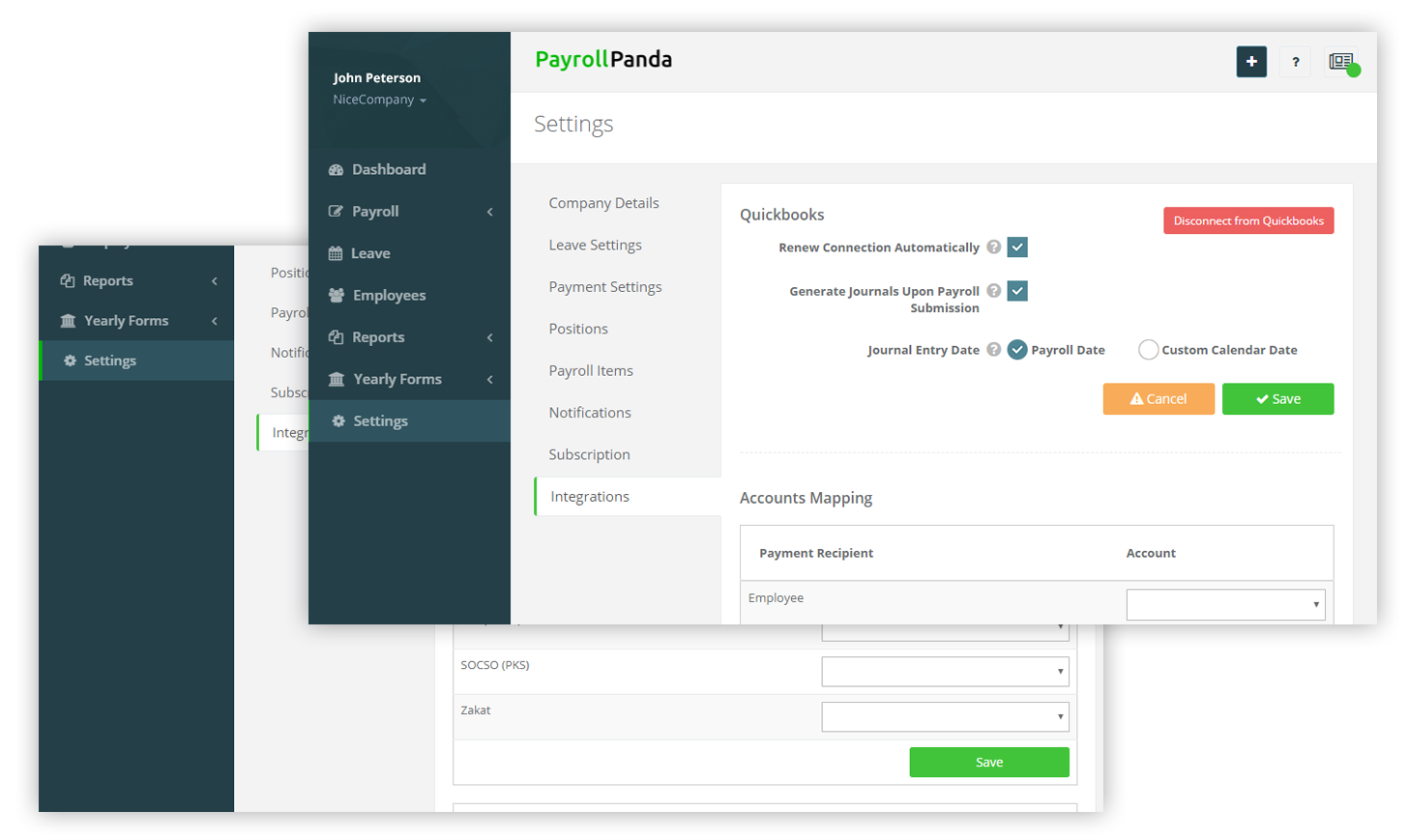

Quickbooks online has made it incredibly easy for me to run and maintain my business from an administrative standpoint. I also enjoy the fact that I can implement labor into my project management to see our profit/loss in real time. I am able to print my own payroll checks and vendor checks when I want and not have to wait for shipping. I really enjoy having all of my businesses extremities implemented under one system. I've switched from ADP to Quickbooks Payroll. Quickbooks did take responsibility for the error by admitting it, but they would not take responsibility for the taxes and penalties. They did not disclose this and admitted that they did not disclose at the beginning nor did they prompt the client to file the return when it came due. QB did not support filing one of the taxes required for the state. I set up a new client on full service payroll with employees in the state of Nevada. Quickbooks processed a duplicate payroll costing my client $15,000+ and despite full documentation that they were responsible, they would not pay for the error. The customer service is tiered so you never speak to a decision maker even when the error is a significant dollar amount. I have a client that uses the full service payroll, and if there is an error where Quickbooks is at fault, it is impossible to ever get them to pay for the error, they will admit the responsibility, but they will not pay for the responsibility.

It is also very easy to use once the setup is complete. The integration with Quickbooks online was a key factor. If you have employees in multiple states, I would not recommend. If you have a simple payroll this is not a terrible product.

0 kommentar(er)

0 kommentar(er)